Numbers don’t lie – if you’re an unsecured creditor, the numbers aren’t pretty

ASIC recently released their corporate insolvencies report for the 1st July 2013- 30th June 2014 financial year. This report collects and summarises information on the lodgements made by liquidators, receivers and voluntary administrators (external administrators) in the financial year for businesses that went insolvent. It gives us an insight into the

- number of businesses that failed

- the size of these businesses

- the reasons for them failing

- how much unsecured credit was never paid etc.

If you wish to view this report in full, you can find it here. In this article, I will be looking closely at certain pages in this document and bringing them into discussion.

How much money was owed to unsecured creditors last financial year?

From the information given in this table we can see that –

- Over 20% of these insolvent companies had more than 25 unsecured creditors.

- By multiplying the minimum amount owed against the number of unsecured creditors for that amount, the amount of money that was unpaid by these businesses is at least $4.24 billion. 27% of these companies had more than $250,000.00 to be paid to their unsecured creditors.

Who are these creditors?

In very simple words, creditors are entities that have provided goods, services or funds to another business and have not been paid yet. There are two types – secured and unsecured. Secured creditors are those that ensure that they secure rights over another business assets if that business cannot honour their debt. Unsecured creditors are those entities who do not reserve this right and hence are not protected if the business cannot pay up. And whenever such businesses go insolvent and their assets are liquidated, the unsecured creditors are the ones that are paid at the very end from whatever’s left after secured creditors have been paid. And this is usually nothing.

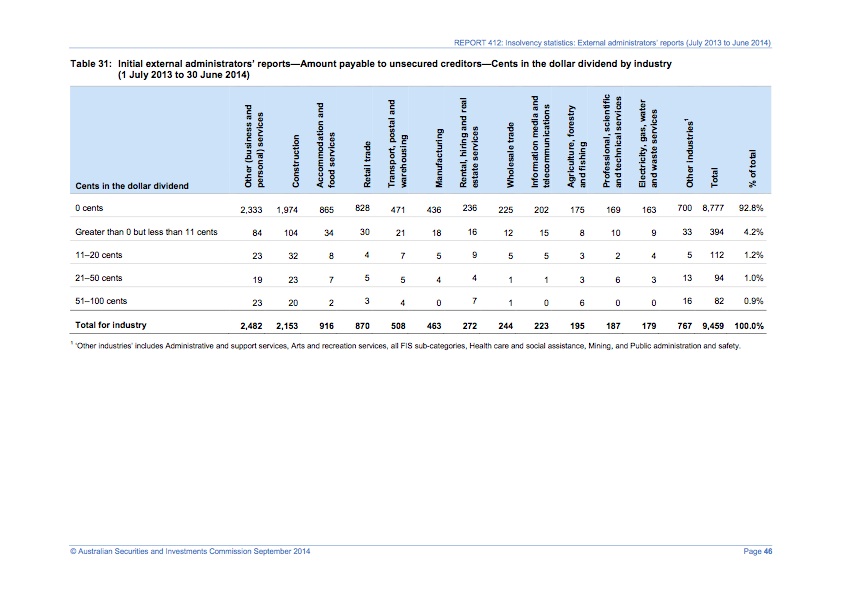

So how much money was recovered?

- Nearly 93% of the businesses that had unsecured creditors were not able to pay even a single cent per dollar they owed.

- Only 1% of these businesses were able to pay at least half of the money they owed.

- So if you were dealing with an insolvent company in the last financial year, the chances of you recovering any money at all if you were an unsecured creditor are practically non-existent.

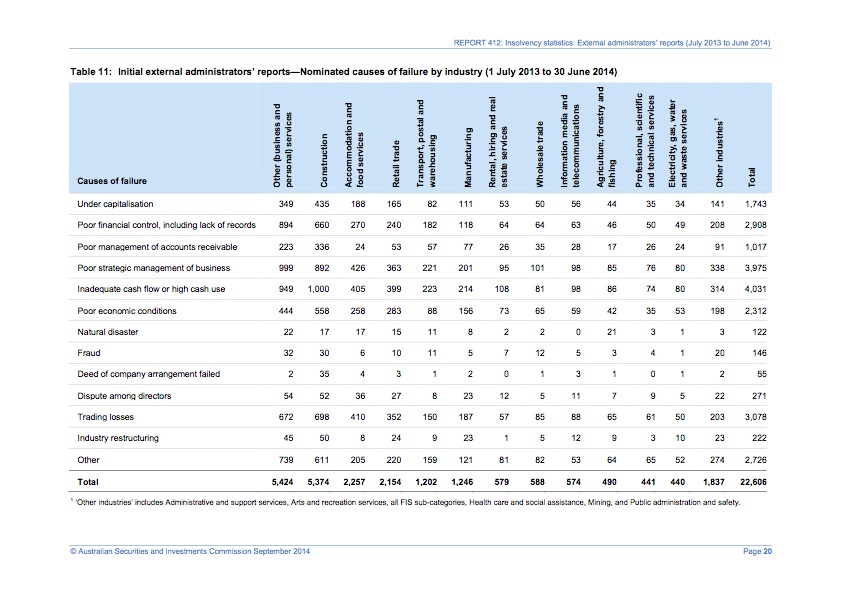

Why did these businesses fail?

- Inadequate cash flow or high cash use, trading at a loss, poor strategic management, poor management of account receivables and poor financial control comprised of almost over 66% of the reasons for failure.

- Professional business or personal services and construction industry had the most causes of failure. (47%)

These companies must have assets that can be liquidated to recover my costs right?

Please click on the images to see an enlarged version

From the stats given above we can see that –

- 86.2% of the businesses had deficiencies of more than $50,000.00. This means that even after all their assets were sold and liquidated to secured creditors, there was still a deficiency and nothing left for unsecured creditors.

- Once again professional services and construction industry had the most number of deficiencies (49%).

Phoenix companies

Another problem when it comes to assets is Phoenix companies. These are organisations with assets that hire work. These assets are then transferred to another company leaving behind just the corporate shell, thus leaving no security for the hired workers. On the right, you’ll see a video by ASIC Commissioner John Price on insolvency and illegal phoenix activity.

How do I protect myself if a company I deal with goes insolvent?

So if you’re a business owner and also an unsecured creditor, in theory there is always a possibility that you may lose money if a business you are dealing with goes insolvent. It’s because you have no control over any of the business’ assets to pay your invoices. The following link is a website run by ASIC which has plenty of good information when it comes to protecting yourself as creditors – http://asic.gov.au/regulatory-resources/insolvency/insolvency-for-creditors/

Do a credit check

One thing you can do is to check the company’s financial history via a credit check. This can either be information available free of cost or via a paid service. Alarm bells should also start ringing if the company you’re dealing with is frequently delaying payments. But in some cases, you may have already committed resources and it may be too late to recover them.

Become a secured creditor

Another way is to be a secured creditor. Before dealing with a business or an individual, make sure that you legally secure rights over their assets if the business or individual is not able to honour the payment for your services and goods on completion. So that when the they go insolvent or bankrupt, your interests are legally protected.

Use an escrow service

Escrow services are another solution you can use to protect your payments. Once funds are held in escrow, they are out reach of other secured creditors and receivers when a business goes insolvent. Up until recently, escrow as a service was only provided by companies like JP Morgan which only operated the service for really large transactions at an institutional level. Services like CheckVault on the other hand are a more retail level service that you can use. CheckVault allows you to get your payment secured upfront from your client, so once the work completes or goods are provided you know that your invoices will get paid without delay.

In summary

So although the numbers don’t paint a pretty picture, one should take into consideration the seriousness of the possibility that at any point down the line, you may end up dealing with a company that goes insolvent and at that point, what security measures would you have in place to protect your interests.

Best wishes.

Important: THIS ARTICLE IS OF A GENERAL NATURE. IT DOES NOT TAKE INTO ACCOUNT YOUR OBJECTIVES, FINANCIAL SITUATION OR NEEDS. BEFORE ACTING ON ANY OF THE INFORMATION YOU SHOULD CONSIDER ITS APPROPRIATENESS, HAVING REGARD TO YOUR OWN OBJECTIVES, FINANCIAL SITUATION AND NEEDS.